vat account - vat account hmrc : 2024-11-02 vat accountJul 31, 2023 — Value-added tax (VAT) is a broad consumption tax assessed on the value added to goods and services as they move through the supply chain. This includes labor and compensation charges, interest .

vat accountAlpine Sterling is a forward-thinking Destination Management Company, rooted in the vast history of the Maltese Islands. Founded in 1969, we’ve grown from a family-run business into a multicultural team of tourism experts with a .

10 products. Filters. Fragrance. Bath & Body. Grooming. CHANEL PARFUMEUR. The Art of Wrapping. Discover ALLURE Homme Sport, a fragrance for men in eau de toilette, cologne and aftershave at CHANEL.com. Enjoy complimentary samples.

vat accountSep 28, 2020 — Your business tax account lets you view and manage your tax position for over 40 taxes, including VAT, PAYE and Corporation Tax. You can also make returns, .Find out how to register your business for VAT, pay your VAT bill, send a VAT return and check your VAT number. Learn about different VAT schemes, rates, exemptions, .Jun 12, 2024 — The term value-added tax (VAT) refers to a consumption tax on goods and services levied at each stage of the supply chain where value is added. As such, a VAT is added from the initial.

vat accountJul 31, 2023 — Value-added tax (VAT) is a broad consumption tax assessed on the value added to goods and services as they move through the supply chain. This includes labor and compensation charges, interest .Aug 8, 2024 — VAT determination: Automate the calculation of VAT for accounts receivable and accounts payable and inter-company transactions. VAT compliance: Calculate and .A VAT return is an official tax document that contains the facts and figures relating to your business transactions, detailing all of your purchases, sales, and expenses. It’s .Jun 4, 2024 — Value-added tax (VAT) is a tax on products or services. Consumers pay the VAT, which is typically a percentage of the sale price. The U.S. does not have a VAT.Learn how to submit your VAT return online using FreshBooks accounting software, which is compatible with HMRC's portal. Find out what information you need, how to avoid penalties, and what are the benefits of digital .Defining and managing key VAT risks; Identifying opportunities to reduce absolute VAT costs and cash flow impacts; Reviewing an organization’s locations, businesses, and supply chain to identify VAT registration .Note: Withholding VAT credits and Excess Input Tax brought forward can be applied against Tax payable. VAT RATES. There are two (2) tax rates:- 16% (General rate) – this rate applies to all taxable goods and taxable services other than zero-rated supplies. 0% (Zero-rate) – this rate applies to specific supplies listed in the Second Schedule to the . The paid VAT amount is transferred from the unrealized VAT account to the realized VAT account. First: Payments cover VAT first and then invoice amounts. In this case, the amount transferred from the unrealized VAT account to the VAT account will equal the amount of the payment until the total VAT has been paid. Last My Account. The Office of the Commissioner for Revenue will issue an acknowledgment for all the above VAT Online services. . or a taxable person who is a physical person may submit online forms in connection with his own personal tax and VAT affairs using his personal e-ID only by using the Personal Services below. He may, .You can also find out VAT information in your business tax account.. Phone. Only call HMRC if you cannot find an answer to your VAT question using our online guidance or services.

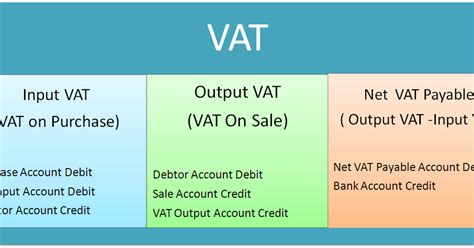

Debit: Output VAT – P12,000.0; Debit: Creditable input VAT – 12,000.00; Credit: Input VAT – P24,000.00; In the above entry, the input VAT is more than the output VAT so the difference is Creditable input Vat. It is a temporary asset account like input VAT and is used to refer to prior-period purchases with VAT.If your company pays over £ 2.3 million VAT per year, you must pay monthly VAT ‘payments on account’ and can submit monthly VAT returns. You can change this through your online VAT account or with the form VAT484. Can I still file my VAT return by paper if I prefer? No. There are very few exceptions to digital filing.

Amazon.com : Chanel Allure Homme Sport for Men Eau De Toilette Spray, 5.0 Oz : Beauty & Personal Care

vat account